When a Melbourne retiree died believing he was engaged to an American man he’d never met, his ex-wife had to prove in the Victorian Supreme Court that the beneficiary of his $2 million estate didn’t exist. Here’s what every executor and will-maker can learn from this extraordinary case.

William Southey was 73 when he died in October 2022. In his final will, made just two months before his death, he left his entire residuary estate—worth approximately $2.5 million including a Kew property—to his “partner” Kyle Stuart Jackson, a man he believed he would marry.

There was just one problem: Kyle Stuart Jackson didn’t exist.

What followed was a two-year legal battle in the Victorian Supreme Court, where William’s ex-wife Kaye Moseley had to hire a private investigator and navigate complex estate law to prove that the man William loved was nothing more than a sophisticated online scam.

The December 2025 decision in Re the will of William Ian Southey [2025] VSC 801 is now a cautionary tale for executors, estate lawyers, and anyone vulnerable to romance fraud.

The Relationship That Never Was

William and Kaye had been married from 1976 to 1989 and remained close friends after their divorce. Following the death of his long-term partner Phillip Seymour in 2017, William began engaging in online relationships.

His final relationship was with someone claiming to be Kyle Stuart Jackson, an American man. The connection began in early 2022, and by August of that year, William was so convinced of its authenticity that he made a new will naming Kyle as his executor and sole beneficiary of the residue of his estate.

The will was made “in contemplation of possible marriage” to Kyle—despite William never having met him in person.

Red Flags the Deceased Couldn’t See

Romance scams targeting older Australians are devastatingly common. In 2025 alone, Australians lost more than $25 million to romance scams, with nearly 3,000 cases reported to Scamwatch.

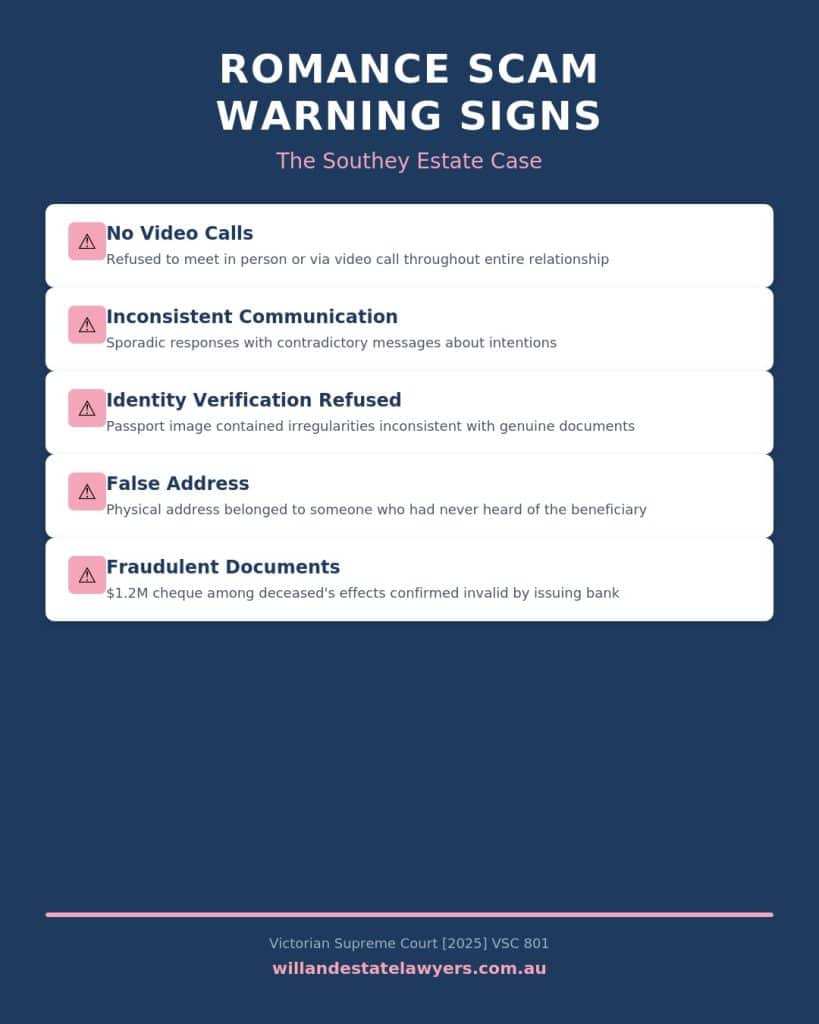

Looking back at William’s situation, the warning signs were textbook:

No video calls or in-person meetings. Throughout their entire relationship, Kyle refused to meet William via video call. All communication was by email and phone only.

Inconsistent contact patterns. After William’s death, when the solicitor and later Kaye’s lawyers attempted to contact Kyle, responses were sporadic and contradictory. Kyle would sometimes claim to want nothing to do with the estate, then demand 15% of its value.

Refusal to verify identity. When asked to provide identification, Kyle eventually sent an image of what appeared to be a US passport—but it contained obvious irregularities. The photo didn’t comply with US passport requirements, and the validity period was shorter than standard US passports.

False address. The Pennsylvania address Kyle provided turned out to belong to someone named Jeremy Snyder, who confirmed no one by the name of Kyle Jackson had ever lived there.

Invalid financial documents. Among William’s possessions was a cheque for over $1.2 million CAD made out to Kyle Jackson for the purchase of artwork. The Toronto-Dominion Bank confirmed the cheque was fraudulent and would never clear.

Retired detective Kylee Dennis, who investigates romance scams, noted that scammers have become increasingly sophisticated, often using artificial intelligence to manipulate victims. The emotional devastation often outweighs the financial loss—one of her clients who lost $500,000 said the worst part was realising the relationship was never real.

The Executor’s Dilemma

When William died, his former solicitor Christina Jones attempted to contact Kyle as the named executor. What followed was a frustrating series of emails that ultimately required formal probate proceedings through the Supreme Court to resolve.

Initially, the person claiming to be Kyle said he was upset about William’s death and wanted nothing to do with the estate. Then he changed his mind, demanding to be kept informed of every step and to receive 15% of the estate’s value.

When Kaye’s lawyers sent renunciation documents to the Pennsylvania address, they received a call from the actual resident—who had never heard of Kyle Jackson.

By October 2023, Justice Keith made orders passing over Kyle as executor, and Kaye was granted probate. For executors navigating complex situations where named executors cannot serve, understanding your duties and legal options is critical.

The Legal Question: What Happens When a Beneficiary Doesn’t Exist?

This wasn’t a simple case of a beneficiary being hard to find. The court had to grapple with something more fundamental: the person William intended to benefit had never existed in the first place. In cases where there’s no valid will at all, the process requires letters of administration instead.

Kaye’s lawyers engaged a US-based private investigator who concluded definitively that the passport image was fraudulent and that Kyle Stuart Jackson was not a real person.

Associate Justice Caroline Goulden accepted this evidence, finding that “the person named in cl 4 of the will as Kyle Stuart Jackson does not exist in the manner understood by the deceased, or at all.”

This meant the gift to Kyle in clause 4 of the will necessarily failed. But did that mean the estate would pass under intestacy rules, or could Kaye take under the gift-over clause in clause 5?

The Gift-Over Clause: “Fails to Survive Me”

William’s will contained a standard gift-over provision:

“In the event that my said partner KYLE STUART JACKSON fails to survive me, I GIVE my residuary estate to my friend KAYE MOSELEY for her own use and benefit absolutely.”

The question was whether “fails to survive me” could be interpreted to cover a situation where the beneficiary never existed at all.

On a strict reading, “survive” presupposes existence. Kyle hadn’t “failed to survive” William because Kyle had never been alive in the first place. The gift-over was drafted for a very specific scenario—Kyle dying before William—and that wasn’t what happened.

However, the court applied a legal principle known as the rule in Jones v Westcomb, which allows a gift-over clause to operate where the circumstances that occurred were “a fortiori” (from even stronger ground) intended by the testator.

Justice Goulden reasoned that William’s clear intention was to avoid intestacy and ensure Kaye would receive the estate if Kyle couldn’t take his gift. The evidence from William’s previous wills—which had consistently favoured Kaye—supported this interpretation.

The court found that while Kyle’s non-existence wasn’t the exact contingency described in clause 5, it was obviously within William’s broader intention. If William had known Kyle didn’t exist, he would certainly have wanted Kaye to inherit rather than the estate passing under intestacy.

The court ordered that Kaye was entitled to distribute the entire residue to herself.

The gift-over clause saved this estate from intestacy. Clear, well-drafted backup provisions are essential. When you’re preparing your will, discussing contingency scenarios with your lawyer can prevent similar complications.

What This Case Means for Executors

If you’re an executor dealing with a beneficiary you can’t locate or verify, the Southey case offers important guidance. For executors navigating complex probate matters, professional legal guidance ensures you’re protected from personal liability while the estate is administered correctly. If you’re facing a probate situation in Queensland with unusual circumstances, our fixed-fee probate applications in Queensland service includes handling requisitions and complications that may arise during the process.

You can’t just ignore the problem. Kaye had to bring a Supreme Court application to get judicial advice on how to proceed. Simply distributing the estate without resolving the beneficiary question could have exposed her to personal liability.

Document everything. The court relied heavily on the detailed records of every attempt to contact and verify Kyle’s identity. Every email, every phone call, every returned letter strengthened the case.

Consider engaging professionals. The private investigator’s report was crucial evidence. Sometimes executor duties require resources beyond what an individual can provide.

The courts will protect legitimate interests. The legal system worked exactly as intended here—protecting Kaye’s legitimate claim while ensuring the estate was administered properly.

For executors navigating complex probate matters, professional legal guidance ensures you’re protected from personal liability while the estate is administered correctly. If you’re facing a probate situation in Queensland with unusual circumstances, our fixed-fee probate applications in Queensland service includes handling requisitions and complications that may arise during the process.

Lessons for Will-Makers

William’s story is heartbreaking, but it contains important lessons for anyone making a will.

Be wary of online relationships. If you’ve never met someone in person, never video-called them, and they refuse to verify their identity—question whether they’re who they claim to be. Scammers are sophisticated and patient.

Review your will after major life changes. William made his will in contemplation of marriage to someone he’d never met. Speaking with a lawyer about your intentions—including concerns about your chosen beneficiaries—can help ensure your will achieves what you actually want.

William made his will in contemplation of marriage to someone he’d never met. Speaking with a lawyer about your intentions—including concerns about your chosen beneficiaries—can help ensure your will achieves what you actually want. For comprehensive protection, estate planning in Brisbane goes beyond simple will preparation to address complex family situations.

Consider your backup beneficiaries carefully. The gift-over clause saved this estate from intestacy. Clear, well-drafted backup provisions are essential.

Keep loved ones informed. Kaye knew enough about William’s situation to recognise something was wrong and take action. If William had been more isolated, the scammer might have succeeded in claiming the estate.

The Broader Picture: Romance Scams and Estates

The Southey case isn’t an isolated incident. With romance scams costing Australians tens of millions annually, estate lawyers are seeing more cases where wills have been influenced by fraudulent relationships.

The Australian Competition and Consumer Commission recommends treating online relationships with caution, especially when:

- The person refuses to meet in person or via video

- They ask for money or financial assistance

- Their story has inconsistencies

- They pressure you to keep the relationship secret

If you suspect you or a loved one has been targeted, report it to Scamwatch and consider contacting IDCARE for assistance if personal details have been shared.

Final Thoughts

William Southey genuinely believed he was in a loving relationship and acted accordingly. His will reflected his sincere wishes. The tragedy is that his trust was exploited by someone who never intended anything but fraud.

Thanks to Kaye’s persistence and the careful application of estate law, the outcome was just. But the case is a reminder of how vulnerable we can be—and how important it is to have properly drafted wills and competent executors who can navigate unexpected complications.

For executors facing difficult situations, remember: you don’t have to figure it out alone. The legal system exists to help resolve exactly these kinds of problems.

While this case didn’t involve a traditional will dispute, it raises important questions about will validity and beneficiary rights. Family members who suspect undue influence or fraud in estate planning should understand their options. Learn more about contesting a will in Queensland and the grounds for challenging estate documents.

Case Reference: Re the will of William Ian Southey [2025] VSC 801 (Victorian Supreme Court, 19 December 2025)

This article is general information only and does not constitute legal advice. If you’re dealing with a probate matter involving unusual circumstances, get a fixed-fee quote for professional legal guidance specific to your situation.